Farmers using innovative insurance to become climate change resilient in Kenya

Organization: APA INSURANCE LTD.

Donor: GOVERNMENT OF KENYA AND THE WORLD BANK

Beneficiaries: 5000

With their livelihoods increasingly impacted by droughts, heatwaves, locust swarms and severe storms, smallholder farmers and pastoralists in Kenya are using new insurance products that utilize satellite technology to strengthen their resilience to climate-related problems.

In a country in which 70% of the population are dependent on agriculture, with the majority of those in the sector being subsistence farmers, many people in Kenya are at particular risk to the effects of climate change, causing hunger and poverty.

For those struggling to support their families, the situation can seem desperate, explains Fridah Kinanu Mugambi, a smallholder farmer, “Sometimes we don’t have any rain, and no water for irrigation, the only thing we can do is pray to God for rain."

Fridah owns 40 acres of land where she grows maize, but harvests have become ever more unpredictable as rainfall patterns have changed – often arriving too late or insufficient in quantity due to climate change. Smallholder farms such as Fridah are not alone, with pastoralists – cattle farmers who are traditionally nomadic – also hit hard by the droughts, as they lack sufficient grazing land for their livestock.

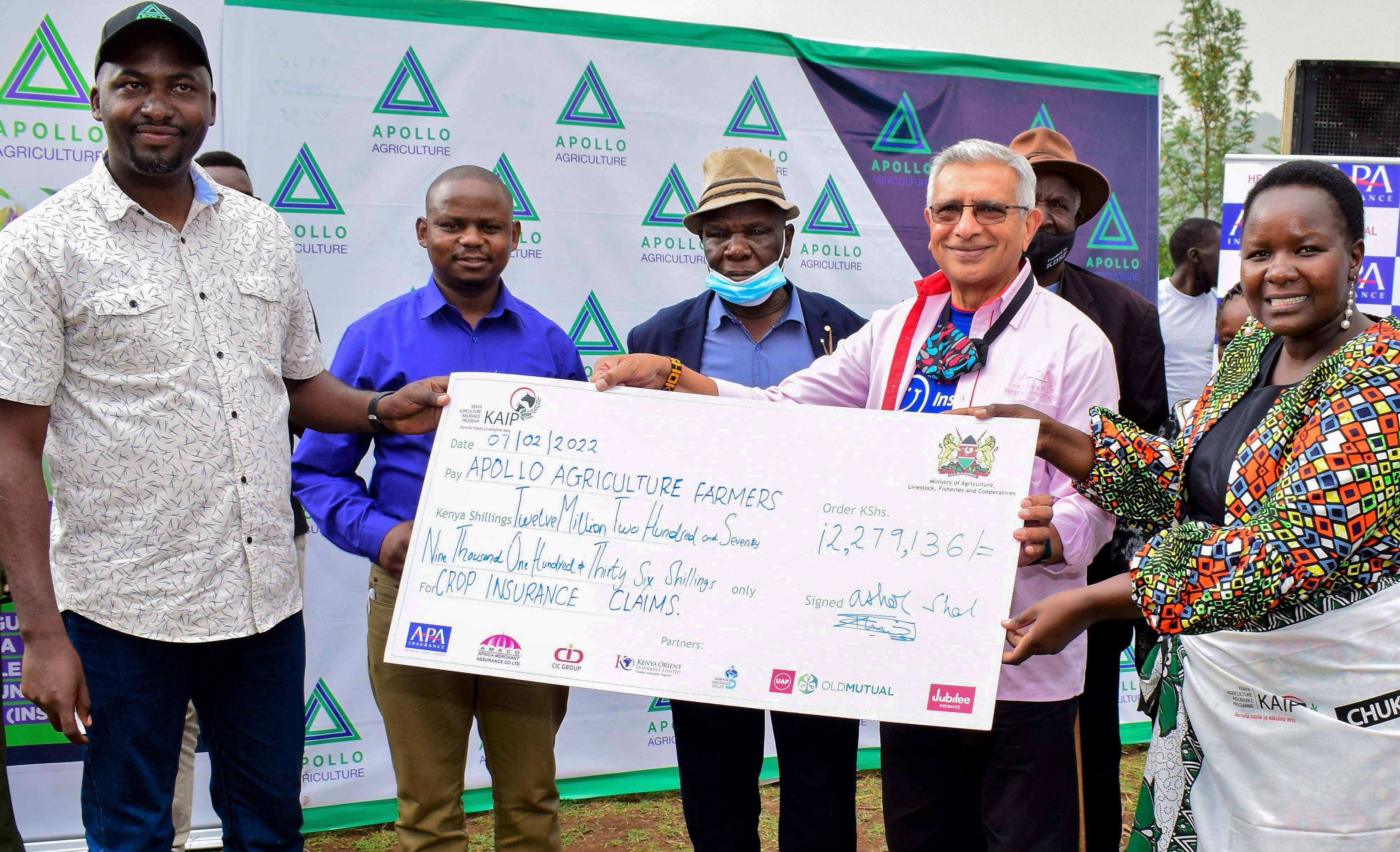

To help protect smallholder farmers and pastoralists from the effects of climate change, the Government of Kenya, in collaboration with the World Bank, provides an insurance subsidy through insurance companies such as APA Insurance. Together with six other insurers, the company has the Kenya Agriculture Insurance group (KAIG), which today offers a range of traditional, hybrid and parametric insurance products for farmers whose crops and cattle are at risk of drought, flood, frost, windstorm, uncontrollable pest and diseases. Furthermore, it has introduced Area Yield Index Insurance (AYII) and Index Based Livestock Insurance (IBLI) to strengthen resilience in East Africa.

“For AYII, we collect the yield data of a particular area from the ministry of agriculture. We cover the farmers with insurance for that yield and pay up to 80 percent,” says Ashok Shah, CEO of APA Insurance. “So if a farmer has a lower yield than 80 percent, we give them the difference between whatever they achieved and up to 80 percent.”

Following a poor harvest in 2019, Fridah received compensation from APA insurance and has been a regular customer ever since. “I was so happy to receive the money because I had no money left then,” she says.

Farmers register for the insurance cover on a season-by-season basis, working closely with the local agriculture officers to provide them with data and propose solutions. This follows awareness sessions and 'training for trainers’ for village champions, who are selected by the county government, which ensures that all demographic groups are fully represented.

The insurance cover is offered at a subsidised rate. If no subsidy is available from the government, the farmers access funding through relevant partnerships and aggregators, as some embed the insurance cover in their products. To ensure timely payments, the service of a number of reinsurance companies was enlisted. The local community aggregators and partners that are part of the value chain are also involved in day-to-day activities.

The project has grown rapidly since its inception in 2016, from 52 farmers across three counties in Kenya, to over 1.4 million small-scale farmers in 34 counties, including Uganda, Zambia and Nigeria, of which 45% are women.

Customer acquisition and strategic partnerships have helped APA benefit from economies of scale and reduce the cost of premiums. While awareness among farmers about how insurance works in many areas is still limited, APA is working on closing the knowledge gap through its farmers education forums.